Stocks rose on Tuesday, extending Wall Street’s winning streak as traders monitored ceasefire negotiations in Europe and key levels in the bond market.

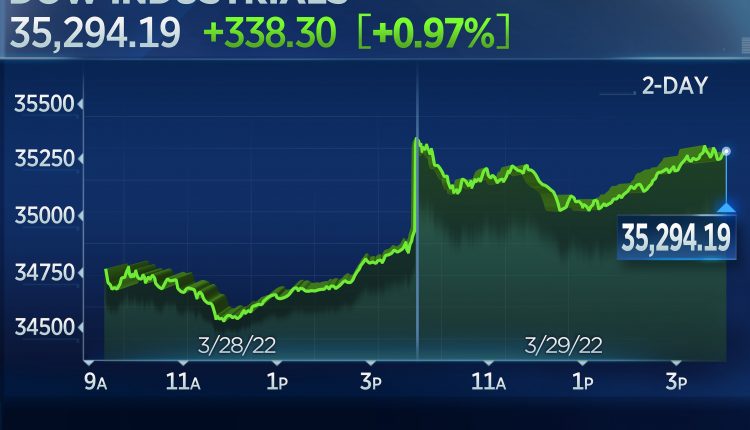

The Dow Jones Industrial Average rose 338.30 points, or 0.97%, to close at 35,294.29. The S&P 500 gained 1.23% to 4,631.60, while the Nasdaq Composite climbed 1.84% to 14,619.64. The Dow and S&P 500 have advanced in four straight trading sessions.

Auto stocks were some of the biggest gainers, with Ford rising 6.5% and GM gaining more than 4%. Travel stocks outperformed as well, with Caesar’s Entertainment surging 5.6% and American Airlines adding 5%.

In tech, Netflix climbed more than 3% and Snap jumped 4.5%. Shares of Moderna rose 4.4% after U.S. regulators approved an additional Covid vaccine booster shot for people age 50 and over.

Traders kept a close eye on the bond market, where the yield for the 5-year Treasury note traded above the 30-year yield at times on Tuesday, an inversion that stoked some recession fears.

The spread between the 2-year and 10-year yields, which economists see as more predictive of a potential recession, also narrowed perilously close to inversion on Tuesday. Some bond pricing sources said the curve did invert, but CNBC data showed that traded just about flat but did not technically invert.

Even when the yield curve correctly predicts a recession, it can still be more than year before the slowdown happens, history shows. Investors appeared to shake off the recession fears on Tuesday.

“Our base case is that the US economy can avoid a recession, lowering the threat of a sustained downtrend in stocks. As such, investors should brace for higher rates—including potentially adding exposure to value and financial stocks which tend to outperform as central bank policy tightens—without overreacting by exiting equity markets,” Mark Haefele, chief investment officer at UBS Global Wealth Management, said in a note to clients.

Growing hope for a Russia-Ukraine ceasefire appeared to help investor sentiment on Tuesday. Russian Deputy Defense Minister Alexander Fomin said Tuesday that the country will “drastically” reduce military activity near the Ukrainian capital Kyiv.

To be sure, both sides have said in recent days they are not close to reaching a deal. Ahead of the negotiations in Turkey, Ukrainian Foreign Minister Dmytro Kuleba said on that “nothing is agreed upon unless everything is agreed upon.” Stocks gave back some of their gains on Tuesday after U.S. Secretary of State Antony Blinken said the U.S. was focused on Russia’s actions more than its words.

Futures for U.S. crude benchmark West Texas Intermediate briefly fell below $100 per barrel on Tuesday morning before rebounding to about $104 per barrel.

“There’s some clear optimism there, but I think the real question is going to be how long do the economic impacts last,” said Yung-Yu Ma, chief investment strategist at BMO Wealth Management.

Comments are closed.